High-Water Mark - Example, Definition, vs Hurdle Rate

By A Mystery Man Writer

Last updated 22 Sept 2024

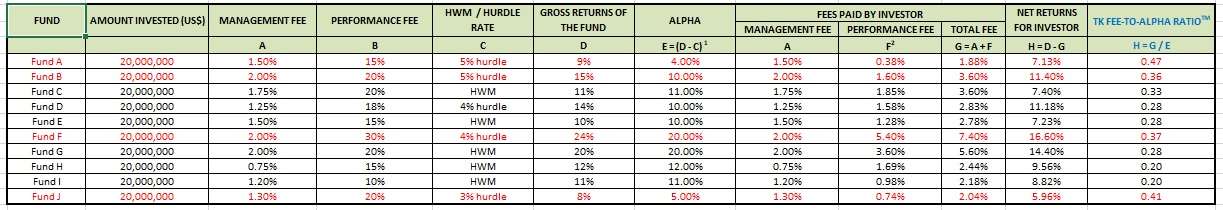

High-water mark is the highest level of value reached by an investment account or portfolio. It is often used as a threshold to determine

High Water Mark How to Find High Water Mark with Examples?

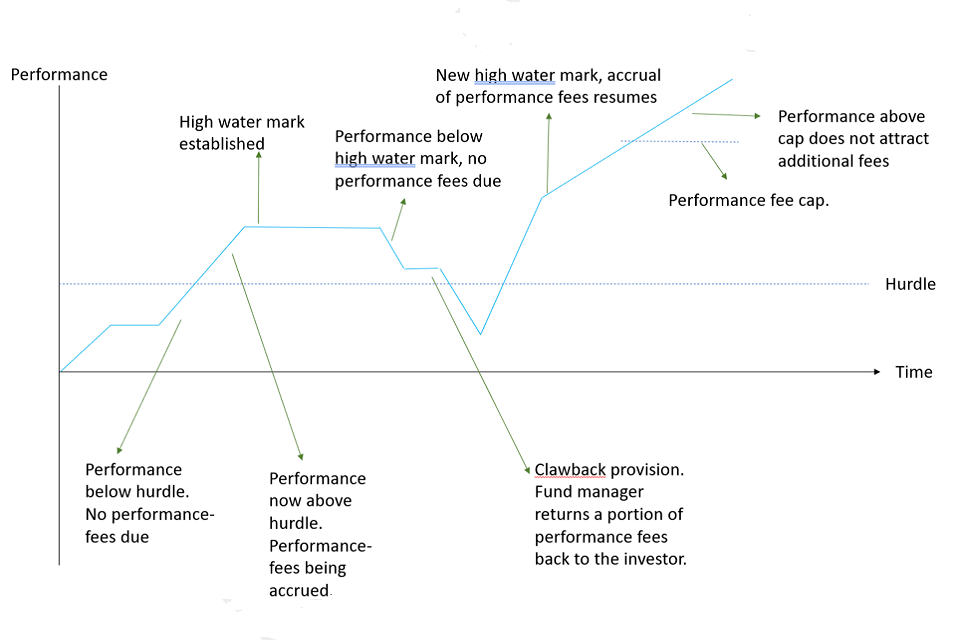

Hurdle Rates V. Highwater Marks V. Claw Back Provisions The Leading Business Education Network for Doctors, Financial Advisors and Health Industry Consultants

Statutory guidance: Disclose and Explain asset allocation reporting and performance-based fees and the charge cap

Investor Primer on Real Estate Waterfalls

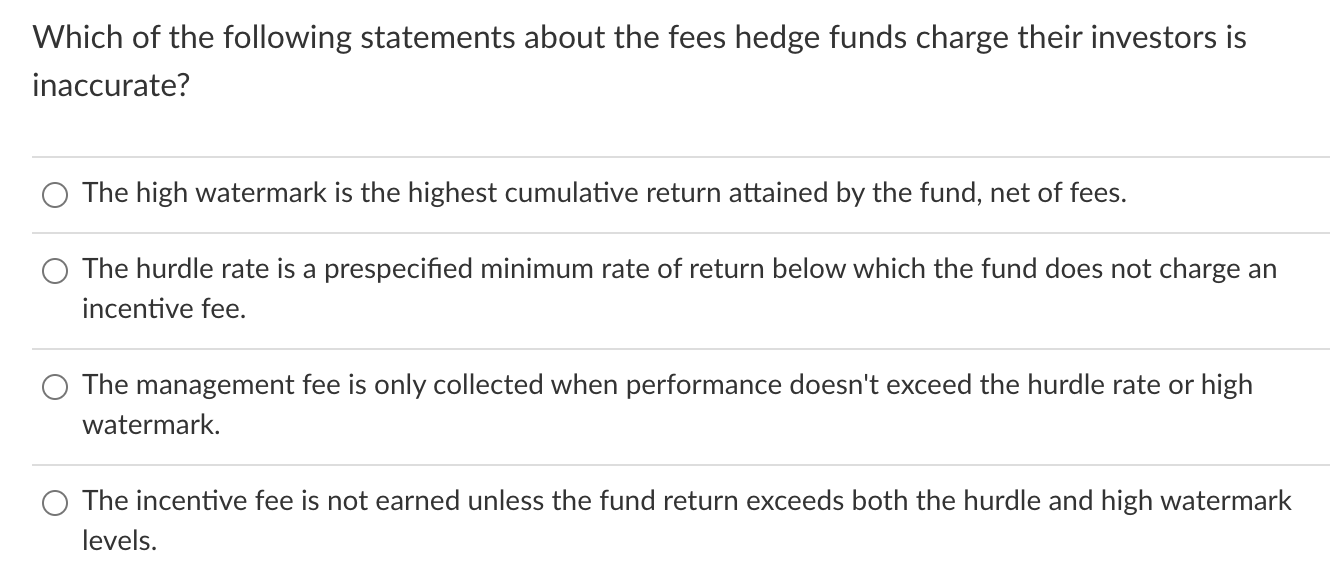

Solved Which of the following statements about the fees

Lock up period: Examining Lock Up Periods and Performance Fee Structures - FasterCapital

Carried Interest and Performance Fee Incentives

HOW MUCH OF YOUR ALPHA DO YOU PAY AWAY TO YOUR HEDGE FUND MANAGERS?, Portfolio for the Future

How Should I Be Paid? – Travis Wiedower

Hedge Fund Terms In Simple English

How Does Carried Interest Work? - Napkin Finance

SICAV Performance Fee Guide

Fund Management AnalystPrep - FRM Part 1 Study Notes

Recommended for you

Hell or High Water - Where to Watch and Stream - TV Guide14 Jul 2023

Hell or High Water - Where to Watch and Stream - TV Guide14 Jul 2023 HELL OR HIGH WATER - Official Trailer HD14 Jul 2023

HELL OR HIGH WATER - Official Trailer HD14 Jul 2023 High-water spots across Houston area14 Jul 2023

High-water spots across Houston area14 Jul 2023 Come Hell or High Water: The Battle for Turkey Creek - Zinn14 Jul 2023

Come Hell or High Water: The Battle for Turkey Creek - Zinn14 Jul 2023 High water mark - Wikipedia14 Jul 2023

High water mark - Wikipedia14 Jul 2023 Hell or High Water14 Jul 2023

Hell or High Water14 Jul 2023 BBC One - Hell or High Water14 Jul 2023

BBC One - Hell or High Water14 Jul 2023 HELL OR HIGH WATER - Official UK Trailer - Starring Chris Pine And Jeff Bridges14 Jul 2023

HELL OR HIGH WATER - Official UK Trailer - Starring Chris Pine And Jeff Bridges14 Jul 2023) How to watch and stream Step Up: High Water - 2018-2019 on Roku14 Jul 2023

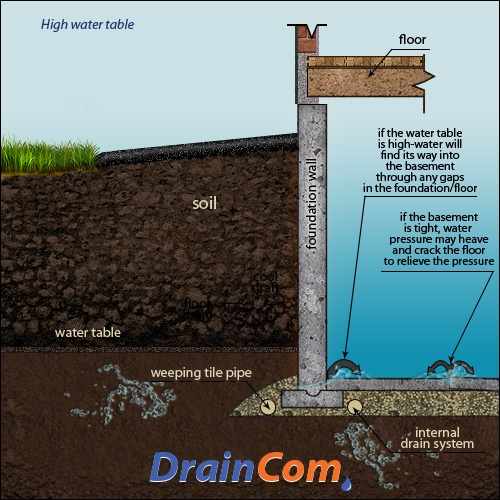

How to watch and stream Step Up: High Water - 2018-2019 on Roku14 Jul 2023 High Water Table Solution, 20+ Yrs Expertise14 Jul 2023

High Water Table Solution, 20+ Yrs Expertise14 Jul 2023

You may also like

Aduloty New Sexy Women's Underwear Set Multi-Color Hollow Printing Screen Gauze Perspective Transparent Sexy Erotic Lingerie – the best products in the Joom Geek online store14 Jul 2023

Aduloty New Sexy Women's Underwear Set Multi-Color Hollow Printing Screen Gauze Perspective Transparent Sexy Erotic Lingerie – the best products in the Joom Geek online store14 Jul 2023 Joyspun Women's Maternity Wrap Front Nursing Bra, 2-Pack, Sizes S14 Jul 2023

Joyspun Women's Maternity Wrap Front Nursing Bra, 2-Pack, Sizes S14 Jul 2023 A Beginner's Guide to Wire Crimping Tools: How to Use Effectively14 Jul 2023

A Beginner's Guide to Wire Crimping Tools: How to Use Effectively14 Jul 2023 Charmo Women Rash Guard Short Sleeve Swim Shirts Swimwear Rashguard Top UPF Sun Protection 50+14 Jul 2023

Charmo Women Rash Guard Short Sleeve Swim Shirts Swimwear Rashguard Top UPF Sun Protection 50+14 Jul 2023 Trico Hybrid Vest - Men's Vests mens, Mens outfits, Vest14 Jul 2023

Trico Hybrid Vest - Men's Vests mens, Mens outfits, Vest14 Jul 2023 Tiger Mascot Waving #1 Finger WiperTags for rear vehicle wipers14 Jul 2023

Tiger Mascot Waving #1 Finger WiperTags for rear vehicle wipers14 Jul 2023 TENA Incontinence & Postpartum Underwear for Women, Super Plus Absorbency - X-Large - 56 Count14 Jul 2023

TENA Incontinence & Postpartum Underwear for Women, Super Plus Absorbency - X-Large - 56 Count14 Jul 2023 Boux Avenue Ammielia longline bra - Bubblegum Pink - 36DD, £18.0014 Jul 2023

Boux Avenue Ammielia longline bra - Bubblegum Pink - 36DD, £18.0014 Jul 2023 Tom Push Up Bra Black – Ladybird Lingerie14 Jul 2023

Tom Push Up Bra Black – Ladybird Lingerie14 Jul 2023 Maidenform GLOSS LACE Tame Your Tummy High Waist Shaping Brief, US Medium14 Jul 2023

Maidenform GLOSS LACE Tame Your Tummy High Waist Shaping Brief, US Medium14 Jul 2023