Collateral damage: Foreclosures and new mortgage lending in the

By A Mystery Man Writer

Last updated 23 Sept 2024

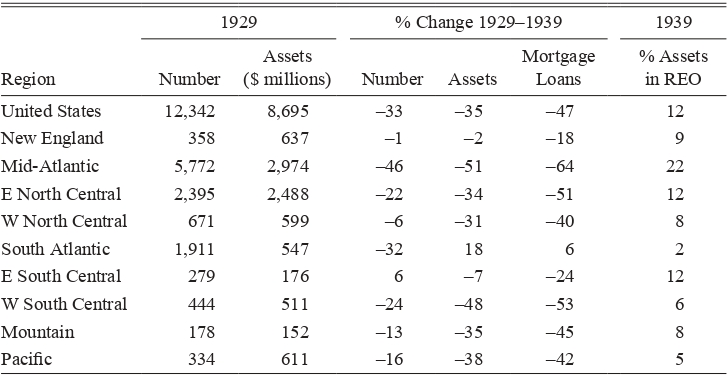

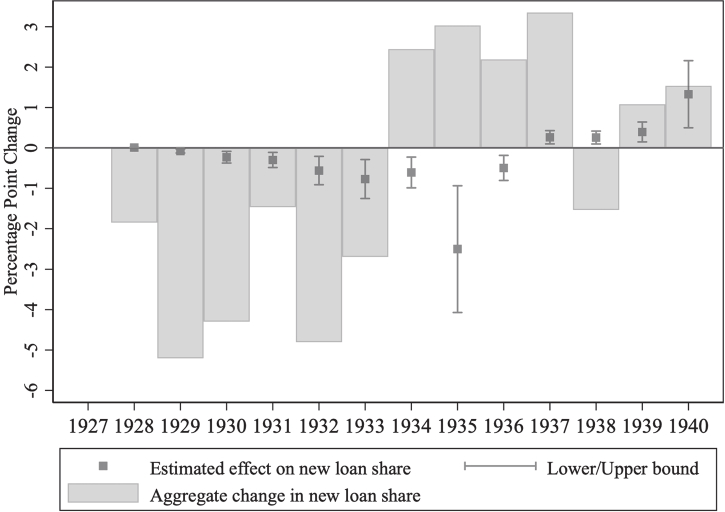

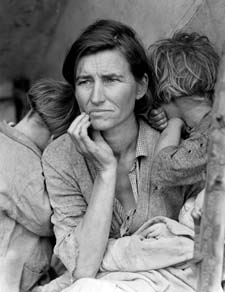

Although severe crises in housing markets contributed to both the Great Recession of 2007 and the Great Depression of the 1930s, the role that housing-related financial frictions played in the crises has yet to be explored. This column investigates the impact that foreclosures had on the supply of new home mortgage loans during the housing crisis of the 1930s. It shows that an increase in foreclosed real estate on a building and loan associations’ balance sheets had a powerful and negative effect on new mortgage lending during the 1930s.

Collateral Damage: The Impact of Foreclosures on New Home Mortgage

Rhode Island Lender Representation Lawyer - PALUMBO LAW

Mortgage: The Power of Sale: Exploring Mortgage Lending and

The Great Eviction: Black America and the Toll of the Foreclosure

Collateral Damage: The Impact of Foreclosures on New Home Mortgage

Bruised but not broken: The state of today's jumbo mortgage market

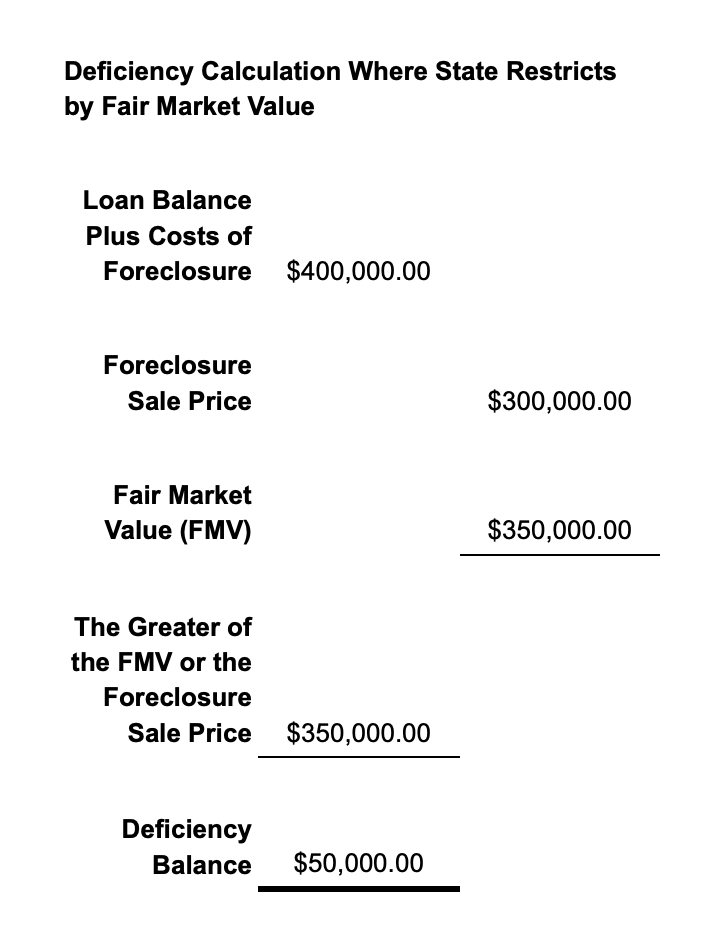

Do I Still Owe the Bank After a Mortgage Foreclosure?

STATE OF THE FORECLOSURE CRISIS: ADDRESSING THE CONTINUED NEED FOR

Why the Fed Can Let the Housing Bust Rip: Mortgages, HELOCs

Collateral damage from mortgage rules

Buying a Foreclosed Home - Connecticut Real Estate

Borrowers Refuse to Pay Billions in Home Equity Loans - The New

Collateral damage. The Spillover Costs of Foreclosures By Debbie

Recommended for you

Is today more reminiscent of the 1930s than 1960s?14 Jul 2023

Is today more reminiscent of the 1930s than 1960s?14 Jul 2023 1930s, Timeline14 Jul 2023

1930s, Timeline14 Jul 2023 Moments of Rupture: The 1930s and the Great Depression14 Jul 2023

Moments of Rupture: The 1930s and the Great Depression14 Jul 2023 This is what it was like to fly in the 1930s14 Jul 2023

This is what it was like to fly in the 1930s14 Jul 2023 The 1930s and The Great Depression14 Jul 2023

The 1930s and The Great Depression14 Jul 2023 The Dust Bowl - Founding of Ducks Unlimited Canada — Ducks14 Jul 2023

The Dust Bowl - Founding of Ducks Unlimited Canada — Ducks14 Jul 2023 Brookings's analysis and recommendations on the Great Depression14 Jul 2023

Brookings's analysis and recommendations on the Great Depression14 Jul 2023 Moments that Defined the '30s14 Jul 2023

Moments that Defined the '30s14 Jul 2023 1930s fashion, 1930s dress, 30s fashion14 Jul 2023

1930s fashion, 1930s dress, 30s fashion14 Jul 2023 Young folks with cars were popular during the Great Depression14 Jul 2023

Young folks with cars were popular during the Great Depression14 Jul 2023

You may also like

As Seen on TV Bra Maid Ball Washer (1-, 2-, or 3-Pack)14 Jul 2023

As Seen on TV Bra Maid Ball Washer (1-, 2-, or 3-Pack)14 Jul 2023- Y2K Óculos De Sol Masculino/Feminino/Vintage/Da Moda/Punk/Para Ciclismo/Esportes14 Jul 2023

Wacoal Womens Red Carpet Strapless Full Busted Underwire Bra14 Jul 2023

Wacoal Womens Red Carpet Strapless Full Busted Underwire Bra14 Jul 2023 Push - Up Montauk Balconette Bikini Top - Mediterranean Blue Ribbed14 Jul 2023

Push - Up Montauk Balconette Bikini Top - Mediterranean Blue Ribbed14 Jul 2023 Arm Shaper Upper Arm Shaper Sleeve Compression Top Women Push Up Breast Post Surgery Front Closure Bra Shapewear Back Support Cropped Tops 231202 From Mang07, $12.9714 Jul 2023

Arm Shaper Upper Arm Shaper Sleeve Compression Top Women Push Up Breast Post Surgery Front Closure Bra Shapewear Back Support Cropped Tops 231202 From Mang07, $12.9714 Jul 2023 54 Partner Yoga Poses for Kids and Teens14 Jul 2023

54 Partner Yoga Poses for Kids and Teens14 Jul 2023 Nike, Intimates & Sleepwear, Nike Swoosh Piece Pad Sports Bra Size Xs Metallic Sheen Blue Camo14 Jul 2023

Nike, Intimates & Sleepwear, Nike Swoosh Piece Pad Sports Bra Size Xs Metallic Sheen Blue Camo14 Jul 2023 Shopping Spotlight: Plus Size Lingerie Picks - Curvy Girl Chic14 Jul 2023

Shopping Spotlight: Plus Size Lingerie Picks - Curvy Girl Chic14 Jul 2023 Race tights e.s.trail, ladies' basaltgrey/acid yellow14 Jul 2023

Race tights e.s.trail, ladies' basaltgrey/acid yellow14 Jul 2023 All Woman 60 denier luxury tights – The Big Bloomers Company14 Jul 2023

All Woman 60 denier luxury tights – The Big Bloomers Company14 Jul 2023