Insurer Can't Flush Away Its Duty to Defend

By A Mystery Man Writer

Last updated 23 Sept 2024

In a recent opinion, the Northern District Court of Illinois reaffirmed the bedrock principle that an insurer’s duty to defend is broad and triggered by any allegations in a complaint that potentially fall within a policy’s coverage grant. In Harleysville Pref. Ins. Co. v. Dude Products Inc., et. al., Case No. 21-c-5249 (N.D. Ill. Dec. 21, 2022), the insured, Dude Products, Inc., sought coverage from its insurer, Harleysville Preferred Insurance Company, against a class action lawsuit that alleged Dude Products intentionally and falsely marketed its wipes as “flushable” even though the product allegedly did not break apart and caused “clogs and other sewage damage.”

How to Clean Sewage Backup in the Basement: 15 Critical Steps

Insurance for contractors: 10 essential policies for construction projects

20 DIY Hacks to Make Your Home Theft-Proof

The Hypocrisy at the Heart of the Insurance Industry - The Atlantic

At-fault Accidents In Ontario

What Is Bad Faith Insurance and How Companies Can Act

if your insurance totals your car, can you reject their offer all together and fix the car on your own? or should I cancel my claim? : r/Cadillac

Labor Department Proposes New Fiduciary Rule to Protect Investors - The New York Times

Frequently Asked Insurance Questions When Buying A Business

Lawrence J. Bracken II - Hunton Andrews Kurth LLP - Experts - Lexology

Recommended for you

- What is the meaning of Back in a flush? - Question about English (US)14 Jul 2023

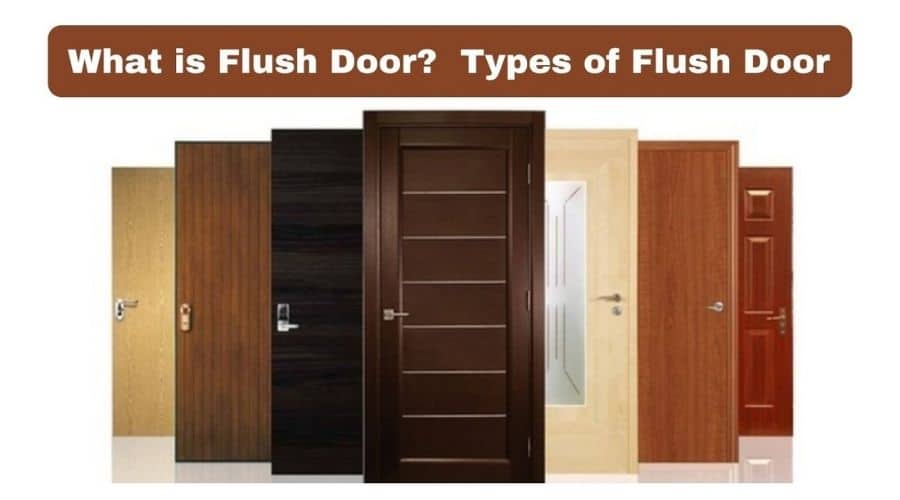

Different Types of Flush Doors14 Jul 2023

Different Types of Flush Doors14 Jul 2023 Qué es flush?14 Jul 2023

Qué es flush?14 Jul 2023 22 Flush away Synonyms. Similar words for Flush away.14 Jul 2023

22 Flush away Synonyms. Similar words for Flush away.14 Jul 2023- What is the meaning of It's gotta be flush with the wood? - Question about English (US)14 Jul 2023

Flush toilet meaning of Flush toilet14 Jul 2023

Flush toilet meaning of Flush toilet14 Jul 2023 Flush Fit vs. Non-Flush Fit Engagement Rings14 Jul 2023

Flush Fit vs. Non-Flush Fit Engagement Rings14 Jul 2023 What Is Flush Door: Types, Meaning & Details14 Jul 2023

What Is Flush Door: Types, Meaning & Details14 Jul 2023 What is the Meaning Behind a Dual-Flush Toilet? - 1-Tom-Plumber14 Jul 2023

What is the Meaning Behind a Dual-Flush Toilet? - 1-Tom-Plumber14 Jul 2023 Hubbell Countertop Receptacles, Surface or Flush Mount Decision Guide – Kitchen Power Pop Ups14 Jul 2023

Hubbell Countertop Receptacles, Surface or Flush Mount Decision Guide – Kitchen Power Pop Ups14 Jul 2023

You may also like

Taiwan Petite Terra Mix 12x12 Seamless Interlocking - Tiles Direct Store14 Jul 2023

Taiwan Petite Terra Mix 12x12 Seamless Interlocking - Tiles Direct Store14 Jul 2023- Hanes Originals Women's 3pk Ribbed Bikini Underwear - Black/beige : Target14 Jul 2023

Popvcly Bra and Panty Sets for Women Crop Top and Ribbed Panties Set Fitness Sports Push up Ladies Underwear14 Jul 2023

Popvcly Bra and Panty Sets for Women Crop Top and Ribbed Panties Set Fitness Sports Push up Ladies Underwear14 Jul 2023 Back Support Belt, Comfort Posture Corrector Back Support Brace Adjustable Shoulder Bandage Corset Back Orthopedic Brace Scoliosis Posture Corrector Strap for Men Women Size XXL Orange : Health & Household14 Jul 2023

Back Support Belt, Comfort Posture Corrector Back Support Brace Adjustable Shoulder Bandage Corset Back Orthopedic Brace Scoliosis Posture Corrector Strap for Men Women Size XXL Orange : Health & Household14 Jul 2023 Vintage Decorated Ornate Etched Brass Vase Peacock Bird Print Black Gold 9.25”14 Jul 2023

Vintage Decorated Ornate Etched Brass Vase Peacock Bird Print Black Gold 9.25”14 Jul 2023 American Eagle Leggings Small Orange Yoga Pants The Everything14 Jul 2023

American Eagle Leggings Small Orange Yoga Pants The Everything14 Jul 2023 Original US WWI BAR Magazine Pouch Belt For Number One Gunner14 Jul 2023

Original US WWI BAR Magazine Pouch Belt For Number One Gunner14 Jul 2023 Asdaddd 7 Vibration Modes Underwear with Remote for Women India14 Jul 2023

Asdaddd 7 Vibration Modes Underwear with Remote for Women India14 Jul 2023 iMucci Professional Girl Ballet Nude Dance Briefs Women14 Jul 2023

iMucci Professional Girl Ballet Nude Dance Briefs Women14 Jul 2023 Buy In Beauty Pack of 6 Non Padded Cotton Demi Cup Bra - Multi14 Jul 2023

Buy In Beauty Pack of 6 Non Padded Cotton Demi Cup Bra - Multi14 Jul 2023

:max_bytes(150000):strip_icc()/bad-faith-insurance-4201054-Final-2-514106ae95e94409a3f000d9641c146b.jpg)