What is the journal entry to record a foreign exchange transaction gain? - Universal CPA Review

By A Mystery Man Writer

Last updated 21 Sept 2024

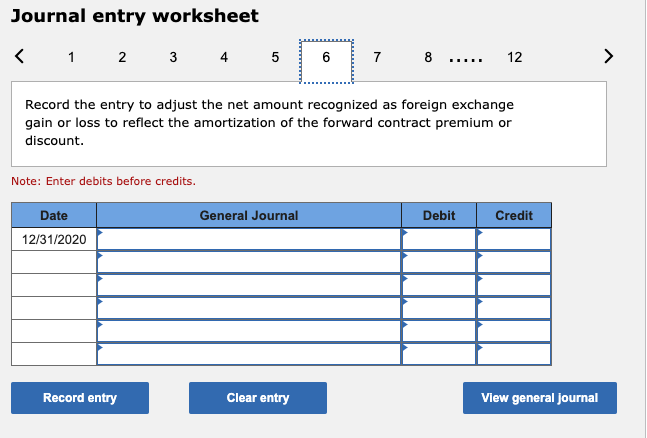

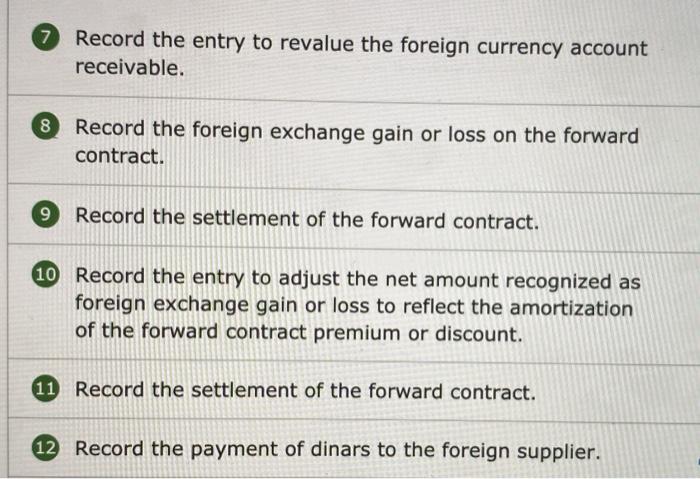

A foreign exchange transaction gain occurs when the transaction currency is different than the reporting currency for the company. On the initial transaction date, they would record the $100 sale with a debit to accounts receivable and a credit to revenue. However, 30 days later when the customer goes to pay using the current exchange

The Case Of The Securities And Exchange Commission Essay

Crash Course Cambridge O Level Accounting 7707 by Azhar ul Haque

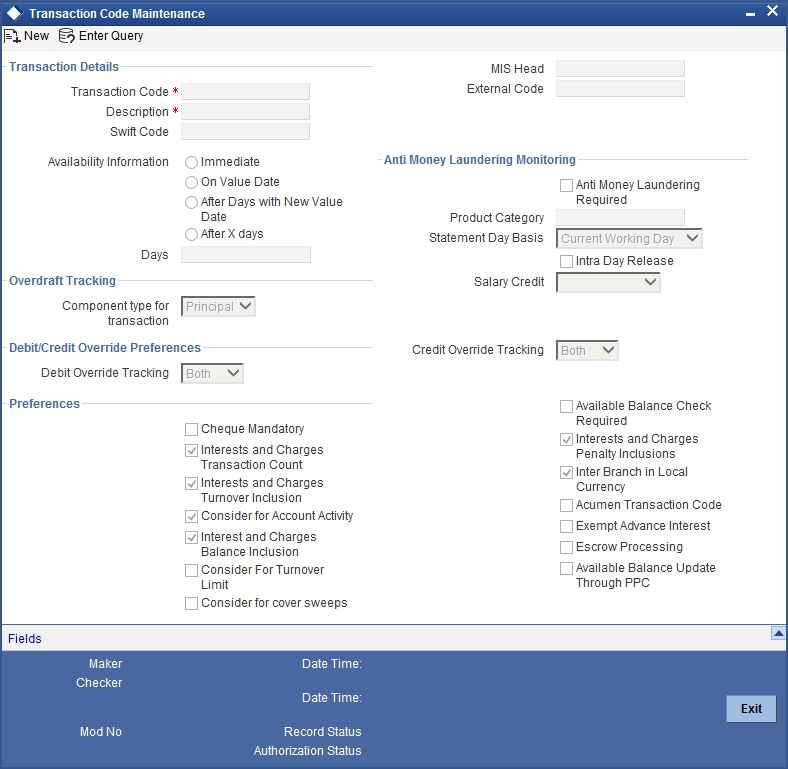

21. Transaction Code

FINANCIAL ACCOUNTING FINAL EXAM

Accounting handbook : Siegel, Joel G : Free Download, Borrow, and

I only need help with B, D, and E. I will post the

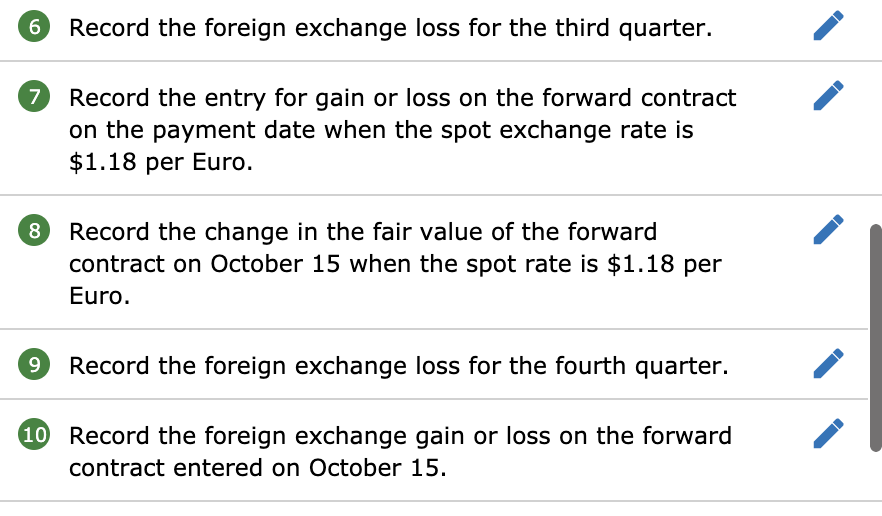

Solved Journal entry worksheet Record the foreign exchange

What Is an Accountant?

Solved Icebreaker Company (a U.S.-based company) purchases

What types of journal entries are tested on the CPA exam

What is the journal entry to record a foreign exchange transaction

Accounting Records: Definition, What They Include, and Types

Volume 14 Number 3 (July to September 2003) - University of the

Recommended for you

- Gain The Edge Official Reviews Read Customer Service Reviews of gaintheedgeofficial.com14 Jul 2023

No Pain, No Gain (2004) - IMDb14 Jul 2023

No Pain, No Gain (2004) - IMDb14 Jul 2023 Gain Flings Original HE Laundry Detergent (72-Count) in the Laundry Detergent department at14 Jul 2023

Gain Flings Original HE Laundry Detergent (72-Count) in the Laundry Detergent department at14 Jul 2023- Gain Therapeutics14 Jul 2023

To gain the power of perspective, go deep not just wide - SmartBrief14 Jul 2023

To gain the power of perspective, go deep not just wide - SmartBrief14 Jul 2023 How Much Weight Can You Gain in a Day?14 Jul 2023

How Much Weight Can You Gain in a Day?14 Jul 2023 Candida And Weight Gain » The Candida Diet14 Jul 2023

Candida And Weight Gain » The Candida Diet14 Jul 2023 8 Medications That Can Cause Weight Gain - GoodRx14 Jul 2023

8 Medications That Can Cause Weight Gain - GoodRx14 Jul 2023 What is the journal entry to record a foreign exchange transaction14 Jul 2023

What is the journal entry to record a foreign exchange transaction14 Jul 2023 Oats For Weight Gain - How To Use Oats For Weight Gain? - The14 Jul 2023

Oats For Weight Gain - How To Use Oats For Weight Gain? - The14 Jul 2023

You may also like

PULLIMORE Women's Sleeveless Tie Halter Tops Summer Loose Casual High Neck Tank Top Blouse Shirts (Green,XL)14 Jul 2023

PULLIMORE Women's Sleeveless Tie Halter Tops Summer Loose Casual High Neck Tank Top Blouse Shirts (Green,XL)14 Jul 2023- Women's Nike Scarlet/Black San Francisco 49ers 7/8 Performance14 Jul 2023

Buy Zivame Vintage Polyamide, Spandex Low Coverage Lace Padded14 Jul 2023

Buy Zivame Vintage Polyamide, Spandex Low Coverage Lace Padded14 Jul 2023 DREAM SLIM Women Waist Trainer Shapewear Tummy Control Waist Cincher Slim Body Shaper Workout Girdle Underbust Corset14 Jul 2023

DREAM SLIM Women Waist Trainer Shapewear Tummy Control Waist Cincher Slim Body Shaper Workout Girdle Underbust Corset14 Jul 2023 Women Who Hike14 Jul 2023

Women Who Hike14 Jul 2023 Jsezml Women's Sexy Low Waist Hot Pants Lace Up Stretch Casual Fringed Denim Mini Jean Shorts Beach Clubwear Booty Shorts14 Jul 2023

Jsezml Women's Sexy Low Waist Hot Pants Lace Up Stretch Casual Fringed Denim Mini Jean Shorts Beach Clubwear Booty Shorts14 Jul 2023- Allegra K Women's Adjustable Straps Full Coverage Mesh Underwire Minimizer Bra Purple 36e : Target14 Jul 2023

CHICWISH Women's Leopard Watercolor Brown Maxi Floral Chiffon Slip Skirt14 Jul 2023

CHICWISH Women's Leopard Watercolor Brown Maxi Floral Chiffon Slip Skirt14 Jul 2023 Jack Black Eye Balm De-Puffing and Cooling Gel - Grooming Lounge14 Jul 2023

Jack Black Eye Balm De-Puffing and Cooling Gel - Grooming Lounge14 Jul 2023 best mesh pet fence Protect-A-Child Pool Fence14 Jul 2023

best mesh pet fence Protect-A-Child Pool Fence14 Jul 2023

:max_bytes(150000):strip_icc()/General-ledger-b821d06e18904b86b246c191d0adc447.jpg)